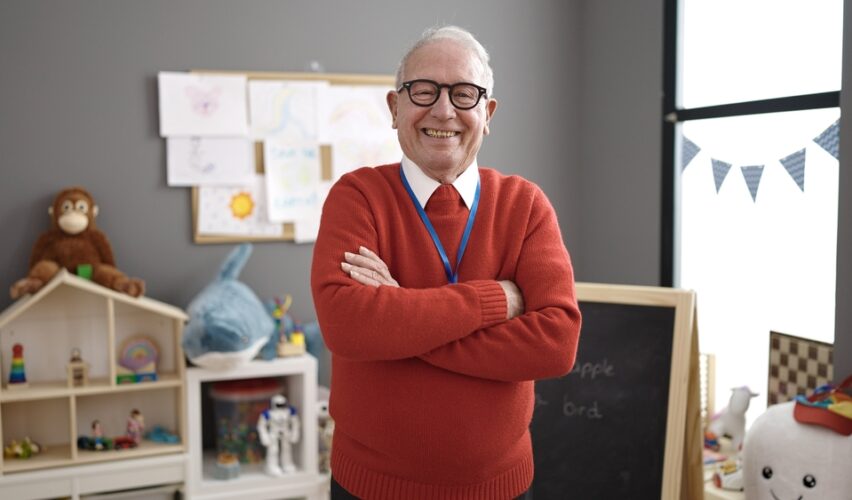

Each year, more and more retirees re-enter the workforce. Known as “unretirement,” a recent study indicates around 20% of retirees have chosen to return to the workforce taking a full or part-time job.

Some say they retired earlier than planned due to the COVID-19 pandemic and then returned to work when there was less risk to their health. Others say they chose to “unretire” for social reasons and the emotional benefit of feeling useful.

Of course, the higher cost of living was another factor considering the record-high inflation in 2022. Then again, re-entering the workforce while you’re collecting Social Security can lower the amount you receive if you file for benefits before your full retirement age.

The Social Security Full Retirement Age (FRA)

According to the Office of Personnel Management (OPM), the average retirement age for federal workers is 61.9 years old. This makes sense because, under FERS rules, you can retire relatively young with an immediate annuity if you meet the age and years-of-service requirements.

However, under rules established by the Social Security Administration (SSA), the Full Retirement Age (FRA) at which you’re eligible for 100% of your earned benefit is now 67 for everyone born in 1960 or later.

If you file for Social Security benefits before you reach your FRA, the amount you receive is reduced. Add to this, if you continue to work while taking your benefits early, you’ll be subject to the retirement earnings limit established each year.

“Any reduction in your benefit due to the earnings limit is temporary.”

The 2024 Social Security Retirement Earnings Limit

The Social Security Retirement Earnings limit applies to people younger than their FRA who collect Social Security benefits and continue to work. For 2024, the earnings limit is $22,320 per year. If you earn more than $22,320 in 2024 while collecting benefits, $1 will be withheld for every $2 in earned income above the limit.

For those who will be turning their FRA in 2024 and continue working while collecting benefits, the limit is $59,520 per year. If you earn more than $59,520 in 2024 while collecting benefits, $1 will be withheld for every $3 in earned income above the limit for the months prior to turning your FRA.

Any reduction in your benefit due to the earnings limit is temporary. Once you reach your FRA, your monthly benefit is increased to account for the withheld funds and there’s no further limit on how much you can earn.

Contact an FRC® trained advisor who can help you weigh the pros and cons of continuing to work after you start collecting Social Security benefits.

Sources: