On February 11, President Trump signed an Executive Order designed to implement the Department of Government Efficiency’s workforce optimization initiative. Agency heads have been instructed to prepare for large-scale reductions in force (RIFs).

RIF Regulations

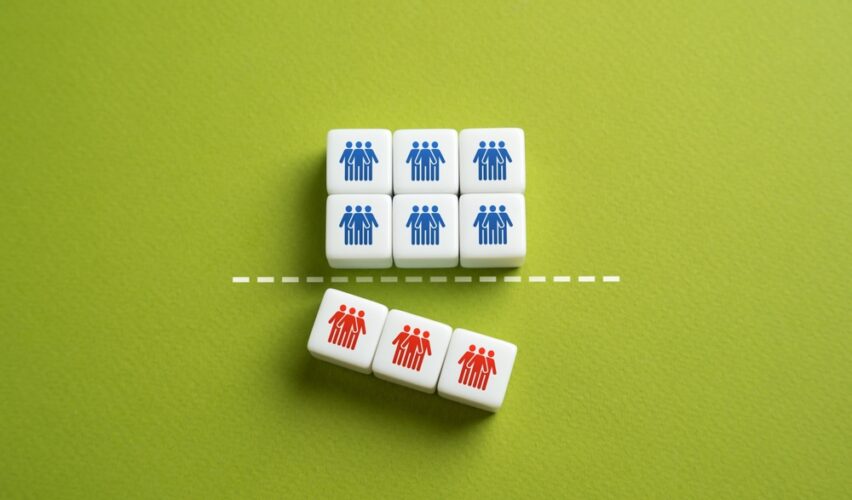

While the reduction in force is aimed at improving government efficiency and workplace performance, there is a legal basis that determines which employees will actually be subject to a RIF action. The four retention factors that must be considered are, in order:

- Tenure/Type of Appointment

- Veterans’ Preference

- Total Creditable Federal Civilian and Uniformed Service

- Performance Ratings – Which Add Years to Your Creditable Service

How RIFs Affect Your Benefits

If you are involuntarily separated from a permanent position, you will likely be eligible for severance pay. However, you must have been employed for at least 12 continuous months and not eligible to retire with an immediate annuity. You also will not be eligible if you refuse an offer of a position:

- In the same commuting area

- In the same agency

- No more than two grades below your current grade level

Only your civilian service is creditable for severance pay. For each year of service through 10 years, you will receive one week of pay. For each year of creditable service beyond 10 years you will receive two weeks of pay. An age adjustment of 2.5% is added for those over 40. The maximum amount of severance you can receive is 52 weeks. This is a lifetime maximum, so any previous severance pay will be deducted from this. Payments will be made at regular pay period intervals.

For those covered by annual leave laws, you are entitled to a lump sum payout of any unused accrued leave. If you are close to retirement age you may be able to use your accrued annual leave to qualify for retirement benefits. You will not be compensated for unused sick leave, but it will be credited back to you if you return to the federal workforce.

Both your FEHB and FEGLI coverage will continue, free of charge, for 31 days after separation. After this period you can continue FEHB for 18 months, 36 months for dependants, but you will pay the full premium along with a 2% administrative fee.

If you are not eligible for an immediate annuity, you can request a refund of your retirement contributions. To receive a refund you must:

- Be separated from for at least 31 consecutive days OR transferred to a position not subject to retirement deductions for at least 31 days;

- Not be reemployed in a position subject to retirement deductions at the time you file your application for a refund;

- Be ineligible to receive an immediate annuity within 31 days of separation;

- Not be prohibited from receiving a refund due to a court order; and

- Notify your current and/or former spouse(s) of the refund request, if applicable.

A Federal Retirement Consultant® can help you navigate your options and create a financial plan should you be subject to a reduction in force.