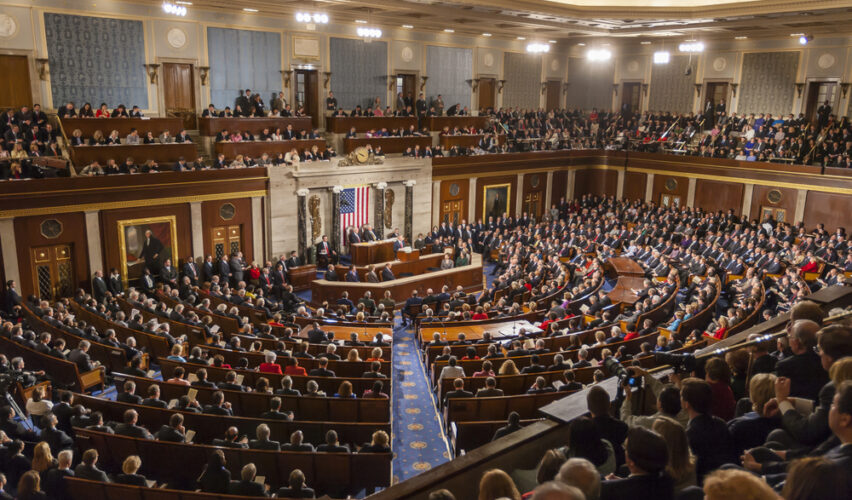

The “One Big Beautiful Bill Act” (H.R. 1), passed by the House on May 22, 2025, underwent late revisions to secure passage. Shortly before 9 p.m. Wednesday, House Republican leaders unveiled a 42-page “manager’s amendment” calibrated to win over the final votes they need to advance the bill over to the Senate.

Changes to Federal Benefits

The implementation of a standardized 4.4% FERS contribution rate had already been removed from the One Big Beautiful Bill Act, but the 42-page amendment also suggested striking language that would have calculated the FERS annuity based on the high-5 instead of the high-3. Rep. Mike Turner (R-Ohio) and many House Democrats sought the change.

Adjustments to Medicaid Work Requirements

One major sticking point for passage of H.R. 1 was the start date for Medicaid work requirements. Able-bodied adults without dependents would be required to fulfill 80 hours per month in a job or community activity to receive Medicare health care. Initially set for implementation in 2029, to win over conservative holdouts, the start date was moved to December 2026. This change addressed concerns that savings from spending cuts were too far in the future. Similar work requirements were expanded in the Supplemental Nutrition Assistance Program (SNAP).

Extending and Enhancing Tax Cuts

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, had several individual tax provisions set to expire in January 2026. Many of these were extended with the passage of H.R. 1, including reduced income tax rates across most brackets and a higher standard deduction, which subsequently has been increased to $32,000 for joint filers. Also introduced is a $4,000 deduction that effectively reduces taxable income for qualifying seniors, lowering or eliminating the tax liability on their Social Security benefits. Continuing the tax breaks, H.R. 1 includes provisions to eliminate federal income taxes on tips and overtime pay.

Late Revisions to Secure Passage

To overcome internal Republican divisions, particularly from deficit hawks and the House Freedom Caucus, the bill underwent significant revisions, culminating in a 42-page amendment approved by the House Rules Committee after a 21-hour markup.

The bill passed the House with a narrow 215-214 vote, almost entirely along party lines, with only two Republicans joining Democrats in opposition. The revisions were crucial to unifying the Republican conference, particularly after a failed Budget Committee vote on May 16, 2025, when Freedom Caucus members blocked the bill for insufficient spending cuts.

The One Big Beautiful Bill Act now heads to the Senate, where further changes are expected, potentially complicating final passage due to differing priorities among Republican senators and the need to reconcile with the House’s delicately balanced package.